Quick Takeaways

- Special provisions employees get enhanced benefits : Law enforcement officers, firefighters, and air traffic controllers receive 1.7% of their high-three salary for each year of service up to 20 years, compared to 1% for regular FERS employees.

- You can work while receiving benefits: Federal Disability Retirement allows you to earn up to 80% of your previous federal salary in private sector work while still receiving your monthly annuity payments.

- Medical conditions don’t need to be work-related: Unlike workers’ compensation, your disabling condition can occur anywhere – on vacation, at home, or at work. Watch our webinar to learn the differences between OWCP and Federal Disability Retirement.

- Strict one-year deadline applies: You have exactly 365 days from separation to file your application with OPM [Office of Personnel Management], making timing critical.

- You continue earning service credit: Every year on Federal Disability Retirement counts as creditable service until age 62, significantly boosting your eventual regular retirement calculation. Check out our video that breaks down this added benefit.

Common Questions

Q: What makes someone a “special provisions” employee?

A: In general, law enforcement officers, firefighters, air traffic controllers, and military reserve technicians count as special provisions employees. Check your SF-50 form – it will specifically state “retirement special provisions” if you qualify.

Q: How much does Federal Disability Retirement pay?

A: 60% of your high-three salary the first year, then 40% each year after until age 62. These payments are taxable and paid monthly.

Q: Can I work while receiving Federal Disability Retirement?

A: Yes, you can work in the private sector and earn up to 80% of what your previous federal position currently pays, on top of your disability payments.

Q: What’s the difference between this and Social Security Disability?

A: Federal Disability Retirement is for occupational disability – you just can’t perform your specific federal job. Social Security Disability requires total inability to work any job.

Q: Do I need to wait until I’m separated to apply?

A: No, you can apply while still employed, on light duty, or taking leave. However, there’s a strict 365-day deadline if you’ve already been separated.

Full Webinar Transcript

Understanding Special Provisions

Ashley: My name is Ashley Withers, I’m a senior federal disability case manager here at Harris Federal, and I’m sitting with Anna Barnes, she’s the director of case processing here. Anna knows so much about Federal Disability Retirement and all the ins and outs of this benefit, so I am so happy to be sitting here with her talking about specifically special provisions.

Anna: Thanks Ashley. I’m so excited to be here.

Ashley: Can you talk a little bit about what special provisions is and how it applies to Disability Retirement?

Anna: Absolutely. Special provisions employees are a group of federal employees who fall under some different requirements for age and service, and then they also have a slightly different calculation for their retirement annuity. These positions get special treatment of their retirement day and the amount the government is actually contributing to their annuity as well.

Who Qualifies for Special Provisions

Ashley: As we know, not every federal employee falls under special provisions. Can you go through the groups, the different departments, the different federal employees that would fall under special provisions?

Anna: Yes, so most law enforcement officers or LEOs fall under special provisions. Firefighters and air traffic controllers also fall under special provisions. And then military reserve technicians do as well, but their age and service requirements are still the same as regular FERS employees. So they get the special calculation, but their age and service requirements are the same.

Ashley: For those that aren’t aware, how would they be able to confirm that they do fall under special provisions? Is there a way that they can check?

Anna: So, there are a few different ways, but the easiest way is going to be checking their SF-50 because it will specifically say right on their retirement “special provisions.”

Key Differences from Regular FERS

Ashley: Can we talk a little bit about how this varies from just the traditional Federal Disability Retirement?

Anna: So, there are a few main differences. The first one is going to be the age and service requirements. If you fall under special provisions, your age and service requirements are either 50 years old with 20 years of service – which means if you’re 50 and you have 20 years under special provisions, you can go out on an immediate retirement. And then also you can go out after 25 years of service under special provisions at any age.

Ashley: And that 20 years – it has to be all under special provisions, correct? It cannot be from military time?

Anna: That is correct. It can’t be military time, and it cannot be other FERS service that was not under special provisions.

Enhanced Calculation Benefits

Ashley: So, under special provisions, the calculation is a little bit different than just the FERS regular calculation. Can you break that down a little bit as to how special provisions under Disability Retirement is calculated?

Anna: Yeah, so under special provisions, a special provisions employee who’s retiring gets 1.7% of their high-three average for each year of creditable service they have up to 20 years. So, they get 1.7% up to 20 years, and then each creditable year after 20 they get 1%.

Ashley: And also, what is that about employees under special provisions having a mandatory retirement age?

Anna: Employees under special provisions have a mandatory retirement, which is different than regular FERS employees – they do not. So, under special provisions, depending on which category you fall under, you are required to retire at age 57, or 56 if you have at least 20 years of service. So, you do not get the choice to continue working – they require you to retire at that age.

Ashley: And at that point you would be eligible for just a regular retirement, correct?

Anna: Correct, so you’d be eligible for your regular immediate retirement.

Federal Disability Retirement Overview

Ashley: Let’s give a little bit of a brief overview on the Federal Disability Retirement benefit. We’re going to talk a little bit about monthly annuity, how those who are eligible for Disability Retirement will receive monthly income, how you can also work in the private sector when approved for Disability Retirement. We’ll also talk about how you will be able to accrue creditable years of service while on this benefit, as well as how you can keep your health and life insurance after approval.

Anna: So, for the first year that you’re on Disability Retirement, you will receive 60% of your high-three salary, and then each year after that you’ll receive 40% of your high-three salary until age 62. And these payments are taxable.

Ashley: And what is the high-three salary?

Anna: So, your high-three salary is your three highest consecutive years of salary averaged. It is generally your most recent 36 months of salary – not always, but that is usually the case.

Working While on Disability Retirement

Ashley: Can you give kind of an example of what it would be like if your high-three was $100,000?

Anna: Sure, so if your high-three was $100,000, the first year that you were on Disability Retirement you would receive 60%, which would be $60,000. And then each year after that until 62, you would receive 40%, which would be $40,000. And those would be your annual income, and those are paid monthly.

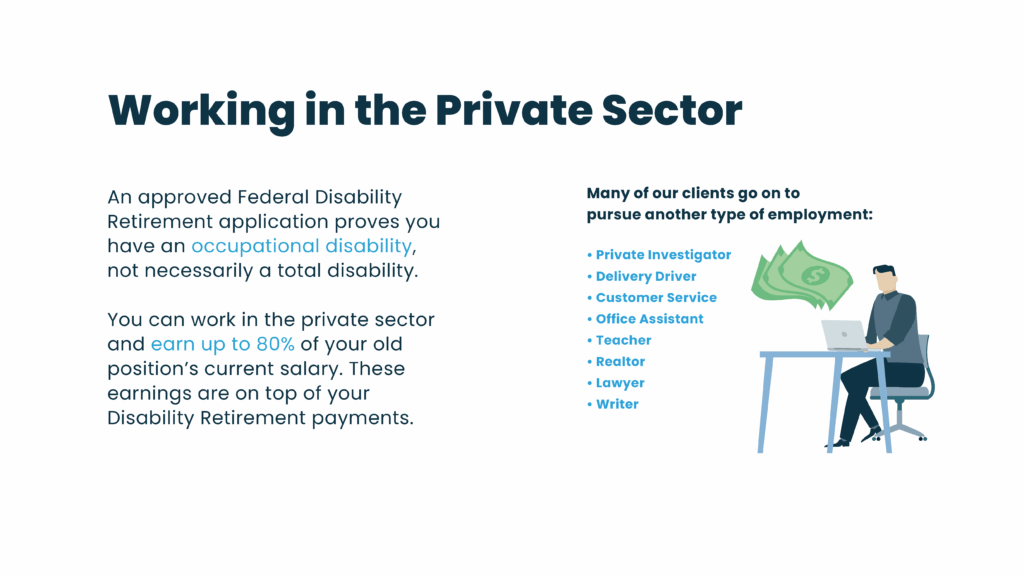

Ashley: And something that is really awesome about this benefit that specifically differs from being on Social Security Disability is that you are able to continue working while receiving Disability Retirement. There are some restrictions though. Anna, can you talk a little bit about those restrictions if someone on the benefit would like to get another job?

Anna: Yeah, so when you’re receiving Disability Retirement, you can continue working in the private sector and earn up to 80% of your previous position’s current salary on top of your Disability Retirement payments.

So we have a ton of clients who go on to pursue a new career in teaching or real estate or many other things. And one thing that’s really important to remember about this benefit is that it is for an occupational disability, not a total disability, which means you can’t perform your current job, but that does not mean you can’t perform other work.

You could theoretically make more money combining Disability Retirement payments with private sector work than you made as a federal employee.

Ashley: So in theory, you could have this benefit, work in the private sector, and make more than you were making while you were working for the federal government?

Anna: Exactly. For example, with a $100,000 original salary, in year one you could receive $60,000 from Disability Retirement plus earn up to $80,000 in private work, totaling $140,000. In years two and forward, you’d get $40,000 from Disability Retirement plus up to $80,000 from private work, totaling $120,000.

Continued Service Credit Benefits

Ashley: And another big perk to the Disability Retirement benefit is while you are on it, you are able to continue receiving creditable years of service. Can you give us just a picture of what that looks like?

Anna: Sure, so as you work in the federal government, you’re accruing creditable years of service for each year that you work there. And if you go out on a Disability Retirement, every year that you receive the benefit until age 62 adds another year of creditable service to your total federal time.

So, this is really important when you’re thinking about what your eventual retirement annuity is going to look like, because those creditable years of service compound when you turn 62 and count towards your regular retirement calculation.

Ashley: So, when you go out on the regular retirement when you flip over to that at age 62, it will be as if you had worked in your federal position until that time?

Anna: Absolutely.

Ashley: And this is another big pro for the special provisions employees because that applies to them.

Anna: That is correct. So, instead of stopping accruing years of service at age 57 or 56 at their mandatory retirement age, they will continue to accrue until age 62 at which time it will switch over to a regular retirement that will still be calculated at the special provisions rate.

Ashley: So, if there was a federal employee under special provisions and they started working for the federal government at age 30 and then they got out on the Disability Retirement at age 40, by the time they turned 62 they would have how many years of creditable service?

Anna: So, they would have a total of 32 years of creditable service. And the really cool thing about this for special provisions employees is that the 10 years that they worked, they’d receive the 1.7% calculation, but also the first 10 years that they’re on Disability Retirement, they would get that 1.7% per year calculation, and then it’s 1% for each year after that.

Ashley: And another awesome point for this benefit is that you are able to maintain your health and life insurance once you have been approved for Disability Retirement. As long as you have those benefits while you are on the rolls you can elect to carry those over into retirement

Medical Conditions That Qualify

Ashley: At this point you might have some questions as to how you might qualify for Disability Retirement. Anna, can you give us some details as to what medical conditions would qualify for Disability Retirement?

Anna: Yeah Ashley, so the medical condition that you’re applying for Disability Retirement must have arisen during your employment as a federal employee, or it could also be a pre-existing condition that worsened during your employment.

So, this does not have to be a work-related condition – it could have happened outside of work. And there are many, many different types of disabilities that could be qualifying for a Disability Retirement.

Ashley: So essentially this is just a condition, disease, or injury that prevents you from performing the duties of your position?

Anna: Exactly.

Ashley: And Federal Disability Retirement specifically differs from workers’ compensation here where the injury or condition does not have to have occurred on the job.

Anna: Right. So, for example, you could have been on vacation and broken your leg and have had permanent issues stemming from that, and that could end up being a qualifying condition for Disability Retirement?

Modified Work Assignments

Ashley: Specifically with medical conditions when they arise, sometimes agencies with the reasonable accommodation and reassignment process will provide a modified work assignment. How does that factor in?

Anna: So, a modified work assignment does not count as an accommodation as far as Disability Retirement is concerned. So you may be working in a modified position because of your restrictions, and that may have been helping you continue to stay employed with your agency, but it’s really important to remember that modified job assignments are not protected and they can be taken at any time.

So, your agency’s not required to keep you in that modified position.

Ashley: So, you can work a light duty, temporary assignment and continue to remain eligible for a Disability Retirement?

Anna: That’s exactly right. So, the only time you would no longer be eligible for a Disability Retirement is if your agency can truly accommodate or reassign you.

And a reassignment has such strict criteria for a Disability Retirement that it is really rare to see a valid offer of reassignment.

Key Point: A valid offer of reassignment must be an existing vacant position within your commuting area, at your current pay and grade level, within your medical restrictions, for which you are qualified.

Ashley: And if the agency does not meet those criteria, a federal employee can decline that offer of reassignment?

Anna: That’s right. They can decline it and it won’t have any impact on their Disability Retirement.

Occupational vs. Total Disability

Ashley: As we mentioned previously, the Federal Disability Retirement benefit is different from Social Security Disability. Specifically, when this is an occupational disability, it does not mean that you cannot work period – it’s just that you can no longer work in your current federal position. Can you give us a little bit more details on that?

Anna: For sure. So like I said, this is occupational disability, not total disability. So you just have to prove that you’re unable to perform one essential duty of your position because of your medical conditions.

And that can be shown with a deficiency in service – so deficiency in performance, attendance, or conduct caused by your medical conditions – or you can be unable to provide useful and efficient service in your position. So, you’re just proving that you can’t perform your current job, not that you can’t perform any job.

Ashley: So, for a specific example, say you have a federal air marshal who has had a knee replacement, can no longer run, defend themselves or others – they would be eligible for a Disability Retirement because they can no longer work as a federal air marshal?

Anna: Exactly. And that’s also a really good example of how that federal air marshal could then go out and get a job in the private sector where he’s not required to run or protect himself, but is still able to earn up to that 80% of his previous salary.

Special Considerations for Special Provisions Employees

Ashley: We’re going to jump back a little bit specifically to special provisions employees and why they should apply for a Disability Retirement if they have a medical condition, disease, or injury that prevents them from performing their specific duties of their position. Anna, can you give us just a little bit of info on those fit-for-duty requirements?

Anna: Yeah, so most special provisions employees are subject to fit-for-duty exams on an annual basis, and these exams measure their physical capability of performing their job. It can also measure their mental capability depending on the exam.

But in the event that they fail a fit-for-duty, they’re almost immediately proving that they’re medically unable to perform the duties of their position.

Ashley: And this is unique to special provisions – not many regular FERS employees have fit-for-duty exams, so this is a really easy way to know whether or not you’re on the path to applying for Disability Retirement.

Medication Restrictions

Ashley: And in addition to those fit-for-duty requirements, a lot of times special provisions positions have medication allowances wherein they cannot take specific medications and be able to perform their duties. How does that factor in?

Anna: So special provisions employees are often required to carry a firearm, so if they’re taking any type of antidepressant or antipsychotic, that can immediately disqualify them from carrying a firearm, which is an essential duty of their position.

Ashley: And there are a lot more examples, but here’s just some of the main ones that we typically see for special provisions employees. And one thing to note here too is that a lot of physical injuries that special provisions employees have can be caused by their training.

Law Enforcement Availability Pay (LEAP)

Ashley: And another point with the special provisions under Disability Retirement is they have the LEAP pay for the law enforcement officer specifically. Can you give us a little bit of info on that?

Anna: Yes, so included in the high-three salary average for most special provisions employees is what’s called LEAP or Law Enforcement Availability Pay. It’s also known as administratively uncontrollable overtime, and this can represent up to 25% of a law enforcement officer’s pay.

There are some agencies that do not include this in their high-three, but to determine which agency that is, you’ll have to take a look at your SF-50.

Ashley: And you’ll be able to see your salary including the LEAP pay on an SF-50?

Anna: Exactly.

Critical Timing Requirements

Ashley: So don’t hesitate to apply for this Disability Retirement benefit even if you have not been separated from service. If you are on light duty, if you’ve been off work, if you just have concerns about the security of your position, you are able to go ahead and submit an application for the Disability Retirement benefit.

We want to specifically touch on the fact that there is a strict one-year deadline to file your application. So while you can still apply while you are on the rolls, you are able to apply if you have been separated, but please keep in mind there is an extremely strict one-year deadline where you have to submit your application to the OPM before you have been separated for 365 days.

Anna: That’s exactly right, Ashley. And you know, this benefit is super complex – there’s a lot that goes into applying for it. I’ve helped Harris Federal Law firm get over 4,500 approvals for federal employees for this Disability Retirement benefit. (Update: As of August 2025, this number has increased to 8,000+ approvals)

And while you can submit an application on your own, it really makes the most sense to have a professional help you, just like you would having your taxes prepared – you’d call a CPA.

Ashley: And while there is reconsideration and you can also go through MSPB [Merit Systems Protection Board] following that, there really is one shot just to get this application correct and strong from the beginning.

Anna: That’s exactly right. I’ve seen clients whose benefit has ended up being worth a million dollars over the course of their lifetime, and there are so many different choices you make at this initial application level that it’s important to really understand what it is you’re electing, what your spouse will receive, what your family will be eligible for.

Ashley: Right, and our firm also works with the doctors to get your medical records, works with the agencies to get those forms completed in addition to going through all the complex application forms that the federal employees themselves would be responsible for.

Key Summary Points

Anna: Well, I think one of the things we talked about a lot was that your medical condition does not have to be a work-related injury.

Ashley: Specifically, that differs from workers’ compensation.

Anna: Right. Another thing that’s really important about this benefit is that it helps you secure a monthly income, so you have money coming in every month.

Ashley: And in addition to that, you can work in the private sector making up to 80% of what your federal position is paying.

Anna: And you do get to continue earning creditable years of service while you’re on the benefit, as well as maintain your life and health insurance benefits.

Ashley: And we went over all those different factors for special provisions – how those employees are eligible and what benefits they can receive, and those specific service requirements.

Anna: And if you are a special provisions employee, it’s important to remember: one, that this benefit is available to you just like any other federal employee, and two, that a lot of special provisions jobs have a lot higher physical requirements, and so it may be a little easier to get approved for Disability Retirement.

Ashley: And we do want to reiterate – do not delay. Just keep in mind that specific one-year deadline to file an application with the Office of Personnel Management. If you have been separated, you have 365 days to get that application submitted.

Anna: I had a great time going over this. I really love being able to educate federal employees who might be eligible for this benefit. We both have seen a lot of federal employees who are in a position where they needed our help, and it’s been a true honor to be able to help them.

Ashley: It has been such an honor to speak with the federal employees that we talk to every day, walking them through this benefit and those eligibility requirements. If you have any question as to whether or not you may be eligible for Disability Retirement, please do not hesitate to call our office. You can schedule a free consultation at any point – we would be happy to speak to you.