Quick Takeaways

- Occupational disability is different from total disability: You only need to be unable to perform at least one major function of your current federal position—not be unable to work entirely.

- You can work while receiving Disability Retirement: There’s an 80% earning cap, meaning you can earn up to 80% of your old position’s current salary while still receiving your full disability annuity.

- Modified or light duty doesn’t disqualify you: If you’re working with restrictions or accommodations, you’re not performing 100% of your job, which means you may still qualify for Disability Retirement.

- Years of service continue to accrue: Every year you spend on Disability Retirement counts toward your pension as if you were still working, significantly increasing your retirement benefits at age 62.

- The financial benefit is substantial: In year one, you receive 60% of your high-three salary; after that, 40% until age 62—plus you can earn private sector income on top of that.

Common Questions

Q: Can I apply for Federal Disability Retirement if I was injured off the job?

A: Yes. Your illness or injury does not have to be work-related or caused by your federal employment to qualify for Disability Retirement.

Q: What if I’m already receiving VA disability or Social Security Disability?

A: You can receive Federal Disability Retirement at the same time as other disability benefits like VA compensation or Social Security Disability Insurance.

Q: Do I have to be completely unable to work to qualify?

A: No. You only need to be unable to perform at least one major function of your current federal position—this is occupational disability, not total disability.

Q: Can I apply if I’ve already been separated from my agency?

A: Yes, but you have a one-year deadline from your separation date to file your application with OPM [Office of Personnel Management].

Q: Will my health insurance continue if I’m approved?

A: Yes. You get to retain your federal health and life insurance benefits while receiving Disability Retirement.

Full Webinar Transcript

Caleb McKinley (Senior Disability Consultant): My name is Caleb McKinley and I’m one of the consultation specialists here at Harris Federal. I’m the senior specialist, I’m also a certified federal retirement consultant, and I have the privilege of every day speaking with federal employees much like yourself around the country who are working—oftentimes working injured, working with medical conditions that have been impacting their lives.

We simply talk for about 30 minutes on what their options are, and we address this question here: is Federal Disability Retirement right for you? Is it right for you at this time? Is this a benefit that you could qualify for in the future? So, we discuss their options.

Today we also have Katelyn Elliott, who’s like me, a consultation specialist here.

Katelyn Elliott (Consultation Specialist): Thanks Caleb. I’m really excited to talk to everyone today. Just like Caleb said, we’re consultation specialists. We do truly enjoy talking to federal employees about this benefit, if it’s right for them, and even what steps they need to take to get to the point that it works for them and that we could move forward.

If we can find out if this benefit’s right for you—which is what this webinar is going to cover—we would love to help you out. You can always give us a call, and we could set up a consultation to discuss what we talk about today.

Who This Benefit Can Help

Katelyn: Right now, we’ll talk about who this benefit can help—specifically federal employees who are struggling to work due to an illness or injury.

Key Point: This illness or injury does not have to be on the job or work-related. This can be an off-the-job injury or even pre-existing.

If you apply for Disability Retirement, it’ll allow you to retire early so that you no longer have to work due to that medical condition that’s expected to persist for more than one year. What we’re talking about here is any illness or injury that’s going to be long term, and as OPM defines it, long term is one year minimum.

Do You Qualify for Disability Retirement?

Caleb: Do you qualify for Disability Retirement? I know me and Katelyn fully agree that this is not for everybody—not everybody qualifies for Disability Retirement. But more people than you would imagine do, and we speak with people every day that we tell them that they qualify, we tell them that they have a strong case, and oftentimes it surprises them.

Part of what we’ll talk about here right now is how we redefine what disability means in this context. We’re not talking about VA disability or even Social Security Disability.

Katelyn: To OPM, a disability is just a medical condition that keeps you from doing at least one of the major functions of your position. That can mean a lot of things.

If you’re a letter carrier and you can’t lift something, then that’s a major function of your job. Or if you’re a CBP [Customs and Border Protection] officer and your doctor says, “Hey, you shouldn’t be wearing your duty vest or your belt,” then that’s also a limitation on the major functions of your job.

There’s a wide definition of what disability is when it comes to relating to your major functions of your position.

Caleb: That’s right, absolutely. As Katelyn said, this is specific to your job. If you are a CBP officer, letter carrier with the postal service, if you work for the VA—really any federal agency—if you’re unable to perform at least one function of your job due to your medical conditions, that would qualify you for Disability Retirement.

Total vs. Occupational Disability

Caleb: Let’s talk then about the difference between total or occupational disability. Federal Disability Retirement requires that the federal worker must have become disabled because of that disease or injury for useful and efficient service in their current position.

This is even more specific. We are looking at your current job—not the job that you had prior, not the job you’re working after. We oftentimes ask our clients and potential clients to provide more detail about what their job requirements are, their performance, their attendance, and their conduct.

We are focusing very heavily on their ability to continue performing in their federal position.

Katelyn: This is not total disability. A common confusion we see with potential clients and those that are asking us “Do I qualify for this?” is that they’re thinking that they can’t be gainfully employed, and if they’re able to work then they can’t do this benefit. But that’s absolutely not true.

There’s several examples. If you’re a letter carrier with orthopedic issues—you need knee replacements—that’s not going to be compatible with having a job that requires you to walk all the time, to lift packages, things like that.

Even for sedentary positions, you could qualify for occupational disability. You have a lumbar issue and you can’t sit for long periods of time, or you have carpal tunnel and you can’t type for more than 15 minutes at a time—then that could possibly qualify you for occupational disability.

Key Point: You need to keep in mind that this isn’t a benefit saying that you can’t work at all. It’s just that you can’t do this federal job for at least 12 months.

Caleb: To reiterate what Katelyn just said, part of the narrative that we’re presenting to OPM on behalf of our clients is that they’re unable to perform solely their federal position—the current federal position they hold, not any other job that’s out there.

That means the vast majority of our clients, even after they’re approved for Disability Retirement, are able to keep working in the private sector. They can find other work that is compatible with their health, different occupations.

Again, we’re simply focusing on the criteria that their current job is not compatible with their health. But any other job that’s out there, if it’s compatible, they do have the option of working in the private sector even after they’re approved for Disability Retirement.

Medical Conditions That Qualify

Caleb: What we’ve done is compiled just a brief list of some examples of some commonly approved medical conditions that we work with daily for our clients at Harris Federal.

Like I said before, your medical conditions and injuries do not have to be caused by your employment, but there is still some criteria that OPM is looking for.

Katelyn: The common conditions we see a lot—you’re going to see orthopedic injuries very commonly, especially with physical type jobs. ADHD, migraines, PTSD, particularly mental health issues.

A lot of people don’t think that their disability may qualify if they have a mental health issue. Some people refer to it as the invisible disability. But if it is keeping you from being able to do your job to its full capacity, then this could possibly be occupational disability.

Other issues we see: fibromyalgia quite often, chronic fatigue syndrome, classic cases or medical conditions that can be difficult to treat. If you’re having issues with that, then it is possible to get Disability Retirement if you meet the requirements.

Caleb: With any of the medical conditions that Katelyn had just mentioned, those conditions either need to arise during employment—so in order for you to qualify, those conditions must have been diagnosed or their symptoms must have been manifest during your employment as a federal employee—or there are pre-existing conditions that worsened during your employment.

We see a lot of folks, a lot of clients of ours who are military veterans, and they have pre-existing service-connected conditions. Those conditions were diagnosed decades and years prior to working for the federal government. However, during their tenure as an employee, they got worse.

That’s really where it helps to have proper treatment, proper medical records from the doctors that can show and establish a worsening of those conditions. But regardless, if those conditions presently impact or impair your ability to do your job, then that will satisfy OPM’s criteria that it was a condition that was manifested while you were on the rolls as a federal employee.

Understanding “Less Than Fully Successful”

Caleb: Let’s explore another term that we’ve used before: less than fully successful. This is part of the OPM terminology, part of the criteria that they’re looking for.

Less than fully successful means there is a deficiency of some kind in performance, attendance, or conduct. Disability Retirement is designed for those who have a disease or injury that makes them less than fully successful in their job.

Part of our work is demonstrating what aspect or element of the job they are unable to perform, or if their attendance or conduct prevented them from retaining their position.

Katelyn: One of the most common service deficiencies we see is in attendance, in particular. If you have had to burn through all of your leave and then you’re in leave without pay, that could be considered an attendance deficiency if we can tie your time in leave without pay to your medical conditions.

Also, performance deficiencies are pretty common to see. If you had fully successful performance evaluations, but over time as your conditions have worsened, you’re getting less than successful or minimally successful, these could possibly be performance deficiencies.

Conduct is a little different. There’s several things that you could show for a conduct deficiency. Sometimes with mental health issues you may act differently in the workplace than you originally did. You may have some issues with co-workers. That could also be considered a conduct deficiency.

Everything we have to keep in mind is that we have to tie it medically to your condition. If we can tie this into your service deficiency, then it is possible to prove that to OPM.

Just to clarify, OPM is just looking for that you aren’t successful in at least one aspect of your job. You don’t need to have a deficiency in all three of these categories—just at least one.

If you have an attendance deficiency alone but you’re fully successful in your performance and conduct on paper, then it’s very possible to do Disability Retirement.

Caleb: That’s a great point. Yes, like Katelyn said, we’re not looking at whether you’re totally disabled from this job. You could be able to do 99% of your job, but if there’s that 1%—that one critical element that you cannot perform—that would be enough for us to establish that you are medically not qualified to continue working, that you do qualify for an occupational disability.

The Modified Work Question

Caleb: Whenever we talk about fully successful, we’re talking about 100%—every single aspect and element that is on your position description. If there is an element that you cannot medically perform, that will qualify you for Disability Retirement.

Oftentimes what we’ll see with an agency is they will offer modified work. We put it in bold here because it’s true: modified work doesn’t count. Your agency cannot offer you modified work and say that they have completely resolved this issue.

Many federal employees that we speak to—and many agencies in general—will offer modified work assignments because of the medical restrictions. We’ve had clients who are medically restricted from lifting, from running, from climbing ladders, from being in tight confined spaces, even down to the environment. They’re not able to be in hot or cold weather, so the agency will give them work inside or they’ll allow them to work from home.

Key Point: The problem with that is a lot of these modified job assignments, especially if they’re not written down with a formal reasonable accommodation, they’re not protected. They can be taken away at any time.

We tell our clients—and this is very common—that even if you are working modified or light duty, you can still apply for and be approved for Disability Retirement while you are working.

Like we had just said with fully successful: being fully successful means 100% of your job. If you are not performing 100% of your job, then you will qualify for Disability Retirement.

Reassignment Requirements

Caleb: It’s one thing to talk about modified work and modifying your current position. It’s another thing entirely to talk about reassignment and for your agency to offer you a new position to work in.

In order for you to accept a new position of reassignment, there’s a lot of criteria that OPM needs to meet, or that needs to be presented to OPM in order for that position to be valid.

It’s got to be a vacant position in your same agency at the same grade or pay level, and it has to be within the same commuting area, within your medical restrictions, and it’s got to be a job that you’re fully qualified for.

Understanding Disability Retirement Benefits

Caleb: Now that we’ve kind of gone over who might qualify and what types of disabilities and injuries would qualify a federal employee, let’s start to talk about what the benefit actually would look like practically and what you’d receive if you’re approved for it.

Katelyn: The first question everyone asks is: how much money will I make on this benefit? Well, it is a fairly generous benefit, especially compared to the rest of the retirement system.

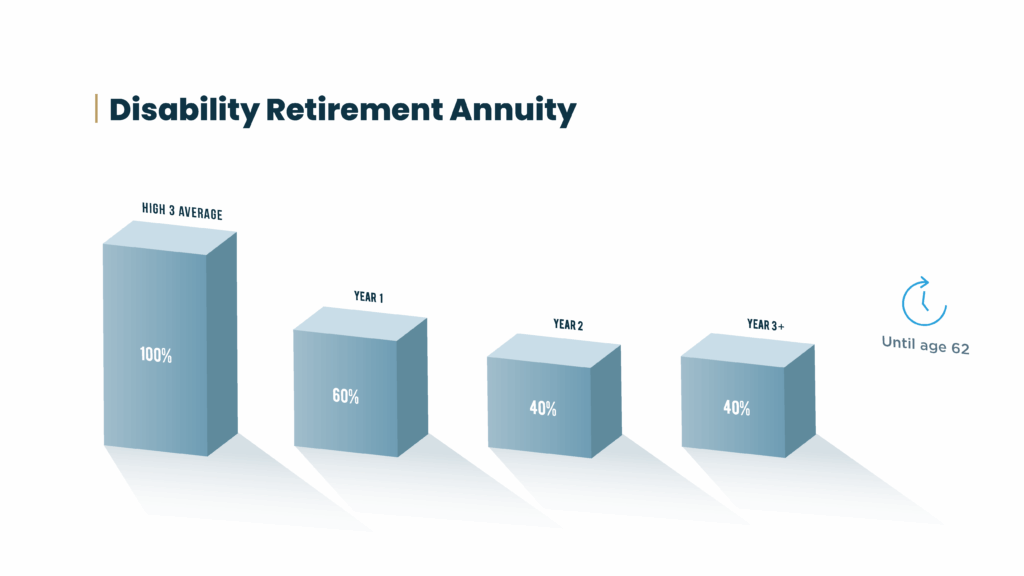

The first year you’re on it, you’re going to get 60% of your high-three average salary—so your highest 36 months of consecutive pay. You’re going to get that the first year. Then every year after that until age 62, you’re going to get 40% of your high-three average salary.

Key Benefit Highlights

Caleb: Now that we’ve discussed how you might qualify for Disability Retirement, whether that would fit your situation, let’s start to talk about the nitty-gritty here and what you would actually receive if you’re approved for Disability Retirement.

This is the question that we often get the most: what is it going to pay? What is the monthly annuity going to look like? That’s one of the biggest highlights here.

You get to be paid monthly by OPM. You get to also work in the private sector. Even while you’re occupationally disabled from your federal position, you can still work another occupation elsewhere.

You also get to continue to accrue credible years of service, and those will be attached to your pension whenever you reach age 62. We’ll talk about that as well.

You get to lock those in and you get to retain your health and life insurance benefits while you receive Disability Retirement.

Katelyn: Like Caleb said, the most important question that we get is: how much does this benefit pay? It is a sizable benefit, especially compared to Social Security or even other retirements in the FERS [Federal Employees Retirement System] system.

The first year you’re on it, you’re going to get 60% of your high-three average salary, which is a sizable amount of your income, especially if you’re not working. Then every year after that until age 62, you’re going to get 40% of your high-three.

You can see that while there is a reduction in your income, you’re still getting a sizable amount of money each month. This does come in a monthly annuity.

Caleb: That’s right. This is stable income. I speak with a lot of folks who are scared—they’re terrified that if they’re unable to work, they will lose everything.

But this benefit shows you that you can—for the first year you’re going to be making more than half of your high-three average, and then a good stable 40% of your high-three every year after. That could be 20 years, 10 years until you reach age 62. But it is a great stable foundation.

It’s going to allow you to get the bases covered. It’s not going to be 100%, but it certainly will provide a lot of good stable financial security. This is a sizable amount of money that a lot of folks stand to gain. They have no idea that they qualify for it, but this money—whether you’re working or not—you’re going to qualify for this federal benefit if you apply for Federal Disability Retirement with OPM.

Importantly, this is taxable income. There is still going to be income taxes that’s taken out. Depending on your age and depending on your years of service, this might change, but keep in mind that this is still subject to federal taxes.

Understanding Your High-Three

Katelyn: You might be thinking, “Well, what is my high-three average?” A high-three is the average of your highest 36 months of basic pay. This will be calculated by OPM once you’re approved for Disability Retirement.

There’s always ways that you can get an estimate of that. You can look at your SF-50s and look at your basic pay and do the math on that, or some people are able to just request that estimate from their HR. You want to have a good idea financially of what you’re going to be making if you’re going to do Disability Retirement.

Caleb: That’s a great point, Katelyn. Yes, if you can calculate this basic pay, what you’re looking at is your locality, your cost of living. Those are included in your basic pay, so it’s not just your base pay.

This high-three average—this is consecutive months. Find that three-year period where your salary peaked, and that’s going to be what OPM considers to be your high-three.

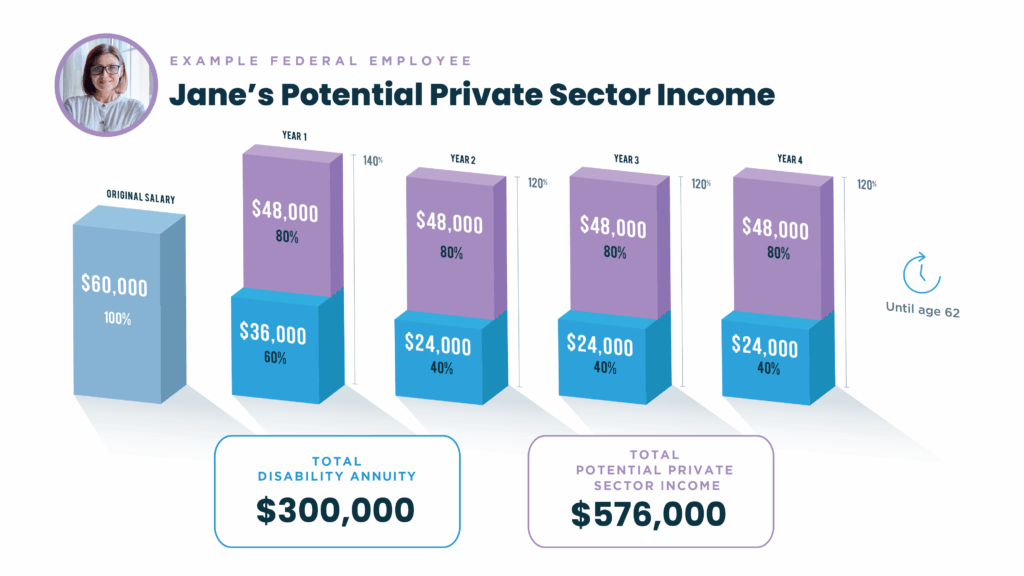

We’ve put together this chart just to provide a visual idea of what this concept would look like year after year. Again, this is depending on your high-three. Let’s just assume that that’s 100%.

In year one, you’re receiving 60% of your high-three. Then every year following—year two, three, four, five, six, etc., until you turn age 62—that’s when you receive 40% of your high-three.

You can imagine how this number—the amount of money that you will receive from the federal government—is going to grow. Keep this in mind. This is just your foundation. We’ve built this kind of like a visual, like a building block.

How Long Does the Benefit Last?

Caleb: Let’s talk about how long does this last. I said before this is a bridge to age 62. This is how you’re able to bridge the gap between now, between today, and the day you turn 62.

This benefit—Disability Retirement—will continue to be paid monthly so that you receive that stable annuity each month. Then at age 62, even if you have special provisions, even if you qualify for an early retirement based on your age and based on your service, this clock will keep ticking until you reach age 62, and then it’ll recalculate into your regular retirement.

Katelyn: Just to elaborate on what Caleb said for special provisions: this is a really great benefit for you in particular. As you know, in special provisions there’s minimum retirement ages and things like that, but this benefit allows you to accrue special provisions years of service until age 62. And it’s also a significant percentage more than most people that were to retire on their immediate annuity.

Caleb: That is a great point. Yeah, regardless of your age at the date of your retirement, even if you do qualify for special provisions retirement, you’re going to get added years of service on top of that.

Again, the clock continues to keep ticking until you reach age 62. Even for a standard federal employee, if you do not have special 6(c) provisions, there’s still a possible 10% bonus if your credible years qualify. If it’s 20 years of service or 30 years of service total, if you accrue more time, then it’ll still factor into your pension whenever you reach age 62.

This is very important for you to think about. You’re not going to lose your pension. That pension is not going to be reduced either. In fact, it’s going to grow for every year that you receive Disability Retirement. It’s a huge thing to consider whenever you’re looking at your future.

Working in the Private Sector

Caleb: Now let’s talk about for the folks that we represent—the federal employees who may not be able to work for their agency but who are capable of working in the private sector. Let’s talk about how this might factor in with Disability Retirement in the picture.

We are providing just the assumption that the federal employee has an occupational disability. Again, they’re not able to walk, run, lift, perform any law enforcement activity, but they’re still able to work. They’re not necessarily qualified for total disability.

A lot of folks that I speak with today are able to work as teachers, realtors. They start businesses, they start their own companies. They’re able to work in ways that they’re passionate about, whether that’s healthcare, daycare.

Keep that in mind: you can still make money, you can still provide for yourself and still stay busy in the private sector while you’re receiving Disability Retirement.

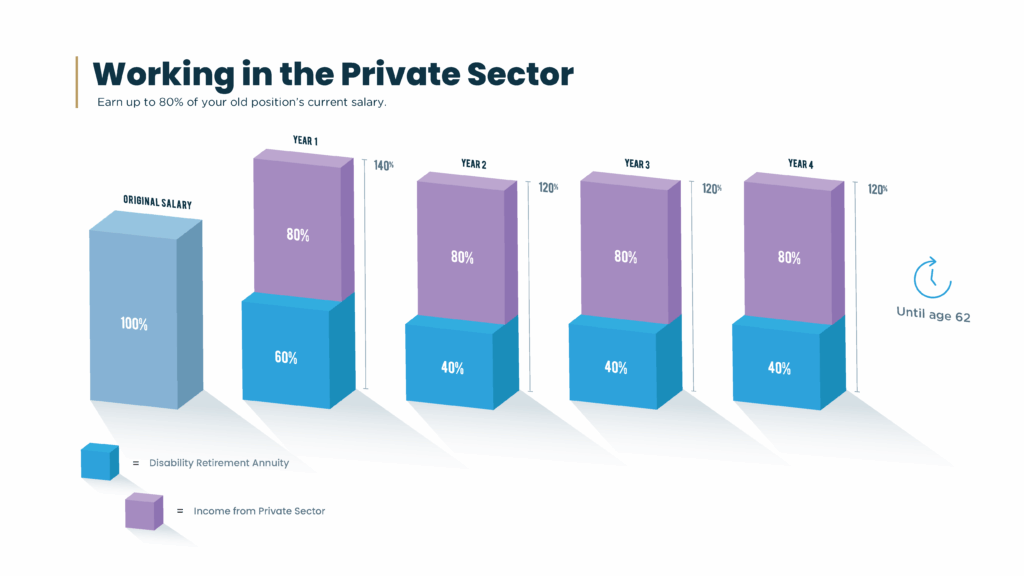

Keep in mind that there is still—with the amount of money that you’re making—an 80% cap. There is a capacity to the amount of money that you can make while working in the private sector.

Katelyn: Caleb mentioned the 80% cap on your earning capacity. You can work in the private sector and you can earn up to 80% of your old position’s current salary and still get your Disability Retirement on top of that.

If you’re on Disability Retirement, you always want to keep an eye on what your income is, but most people that we talk to are able to earn comfortably within the 80% and still have their nice Disability Retirement on top of that.

I tell people: this benefit, think of it as opportunity. You get to do a new career that works for you in your medical conditions. It’s a big opportunity for a big change that can be really positive in your life, but you’re still able to earn a livable wage.

The Financial Picture: Working Plus Disability Retirement

Caleb: That’s right. Even though you’re working again, you’re going to be working less. There’s still that 80% cap, but as we’re going to show you here, you can be working less but making more.

Let’s talk about how this will all factor in. Going back to the building blocks that we had established in the previous slide, you’ll have 100% at the very far left of your original salary.

Down below, you’ve got 60% for that first year and 40% every year after that—that’s just your Disability Retirement annuity, those are the payments that you’re receiving from OPM.

Now you build on top of that what we had just talked about, which is up to 80% of your old position’s current salary.

The first year, if you add those two blocks together, you’re going to be receiving upwards of 140% of both Disability Retirement and your income from a private sector combined.

Then every year after, it’s 120%. Not only are you paying the bills, but you’re making more. Again, you’re working less because your medical conditions and your doctors have urged you that it’s time to slow down, it’s time to find a different career.

Like Katelyn said, this career can be a very positive change. You can still work, still be active and still be fruitful, but the point to Disability Retirement is it is a solid foundation for you to build new income and new financial security on top of.

Accruing Credible Years of Service

Katelyn: Credible years of service—that’s one of the best benefits to Disability Retirement: getting to accrue years of service.

If you’re retiring at age 42 on Disability Retirement and you have 10 years of service, by time you turn age 62 you’re going to have 30 years. You have 20 years that you didn’t have to work for in the federal government that you’ll be entitled to when you turn age 62, which is a pretty significant percentage when you’re thinking of how regular retirement is calculated.

You want to have that waiting for you at age 62 when you fully retire.

Caleb: That’s right. A lot of folks will just consider the amount of time that they worked to be factored into their pension, so they’re only going to calculate their pension based on the years of service that they actually worked.

Yes, you’ll continue to keep those years, but also every year following until you turn 62, those will count exactly the same as if you were still working as a federal employee.

Example: Jim’s Story

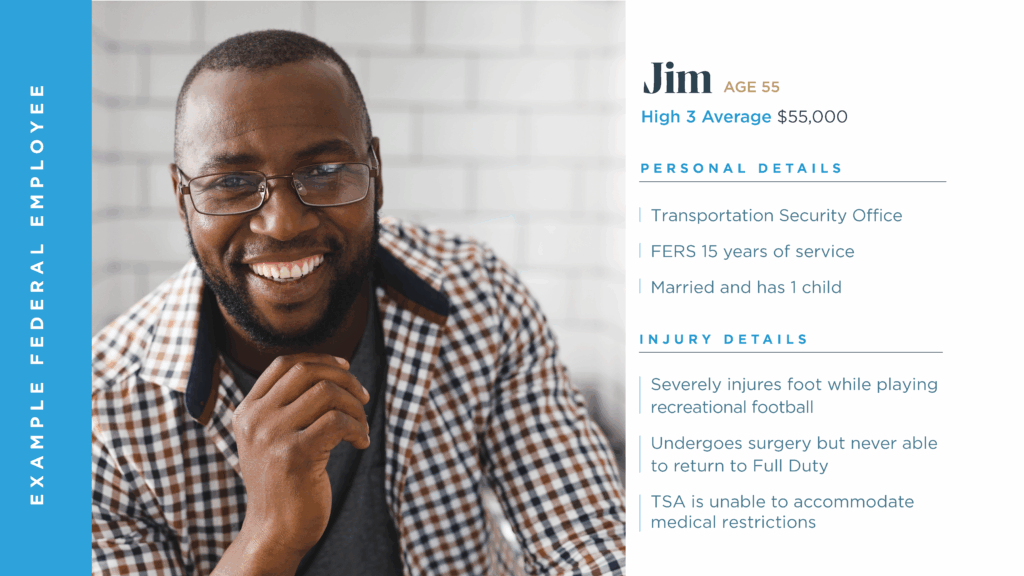

Caleb: Let’s kind of bring this all to a more practical level. Let’s zero in on an example of a typical federal employee. Let’s just call him Jim.

Jim is 55 years old, and his high-three average is also $55,000. He’s a transportation security officer, so he works for TSA. He’s been a covered FERS federal employee for 15 years. He’s married and has one child.

Unfortunately, Jim has been unable to work because he injured his foot while he was playing football. Unfortunately, he has to go through surgery. He’ll never be able to return to full-time, full duty standard.

TSA is unable to accommodate because he was not able to meet his fit-for-duty standards—medically disqualified. He cannot continue to work due to his medical restrictions.

He’s in this limbo period where Jim’s deciding and trying to calculate what to do with his career, with his early retirement. Let’s talk here about some numbers, about what his potential—not just private sector income—but Disability Retirement would be.

If Jim were to apply for Disability Retirement using his starting salary at $55,000, the first year of Disability Retirement he would just be paid by OPM $33,000, which is 60% of his $55,000 salary.

On top of that, if Jim’s able to work in the private sector, there’s an additional $44,000. That would apply every year following.

The second year, what Jim is receiving from OPM will drop to $22,000, but you’ll see that total—he’ll be able to exceed 120% of his original salary.

Add up all that time, add up that total Disability Retirement—that’s $153,000 that Jim was able to receive just from Disability Retirement. Then his total private sector income, the amount of money he was able to earn from wages, was $308,000.

All that money—if you’re looking at your own personal situation here, if you’re plugging your own high-three, your own salary into this calculation, into this chart—keep in mind this could be a substantial amount of money that you stand to gain here.

Definitely, if you have questions about this, we’d be happy to help. We’d be happy to have a consultation with you and go through this in detail. But certainly consider your age and your salary whenever you’re looking at what Disability Retirement could potentially pay you if you qualify.

Katelyn: Yeah, Caleb. In this situation, he would be getting $461,000 over seven years, which is $65,857 per year. That’s a sizable income.

Caleb: That’s right. Let’s also take into account now, as we discussed prior, his credible years of service. He’s already been a TSA employee for 15 years.

Whenever Jim medically retires, he’s going to tack on an extra seven years to his pension. It’s going to come out to equal 22 total years of service.

All that time—the time on the rolls and the time spent on Disability Retirement—they count the exact same, just like Jim still working as a federal employee for those seven years.

I hope that you guys understand that this is not just benefit month to month. This is not wasted time. This is time that’s going to be fruitful. For seven years, the benefit starts to add up, it starts to accumulate.

This is not wasted time. Once you medically retire, that’s not the nail in the coffin. This is just the beginning of how your benefit is going to accrue over time. Consider that certainly whenever you look at your retirement options.

Example: Jane’s Story

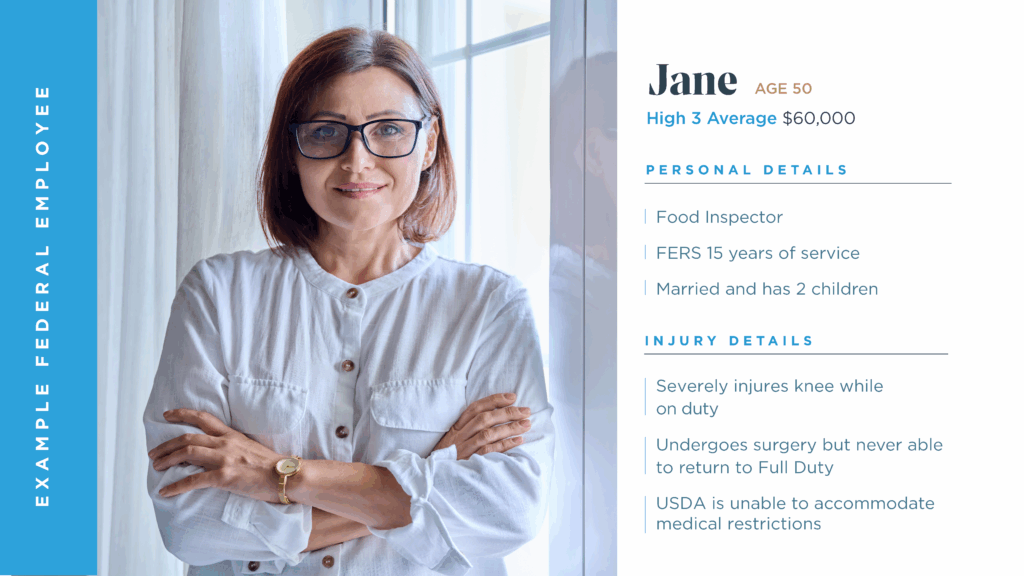

Katelyn: Now let’s look at one more example while we’re here, just so you understand this benefit. We have Jane. She’s 50 years old and she has a high-three of $60,000. She’s a food inspector. She has 15 years of service, and she’s married and has two children.

Let’s take a look at Jane’s injuries. She severely injured her knee while on duty—which is different than what happened to Jim, who was injured off duty. She underwent surgery but was never able to return to full duty, and the USDA was unable to accommodate her medical restrictions.

With those facts, and now that we know that Jane qualifies for Disability Retirement, we can start to talk about the math and how the money will shake out here for her potential future.

For Jane’s earnings with her original salary at $60,000, the first year she has the capacity to make $48,000 working in the private sector. That will continue to apply, so she’ll be able to make $48,000 every year following until she reaches age 62.

Because Jane is 50 years old, that’ll be for 12 years.

Disability Retirement for the first year will be calculated at $36,000—a little bit more than Jim—but then it’ll drop to $24,000 every year following until Jane turned 62, which again will be 12 years.

Just factoring in her Disability Retirement annuity for 12 years with a high-three of $60,000, that is $300,000 that Jane is earning not by working, just by receiving Disability Retirement monthly.

Then on top of that, Jane has the potential to earn an additional $576,000 for 12 years. Look at this. This is not out of the ordinary. A high-three of $60,000—if you look at it in the long run, for 12 years receiving Disability Retirement, this is a substantial amount.

Let’s add this number together. Just from Disability Retirement: $300,000. Then the potential to earn an additional $576,000 in the private sector.

Jane can work as a realtor, teacher. She could be a counselor. She can do something that is sedentary that doesn’t require the use of her injured knee.

This will be for 12 years: $876,000, which is $73,000 a year.

Jane has maximized her income. She’s been able to medically retire because she was unable to work, but she still found a way to make well over $875,000.

Again, these 12 years that she spent was not wasted time. Jane was able to work. She spent time on Disability Retirement getting credible years of service.

Now you add 15 years of service that she already had—time that she already had credited under FERS—then you add the additional 12 years of time on Disability Retirement. That shakes out to 27 total years of service.

She’s effectively increased her pension to 27 years of service as opposed to just 15.

Now when Jane turns 62, it’s going to look like she’s been working for the USDA for the past 12 years, even though she hasn’t stepped foot in that building for the last 12 years. She’s still going to get all of that credit. All that time is going to continue to count.

As you’re looking at this, please remember that even if you medically retire at age 50 or even younger or older, when you medically retire it still looks like you’re working as a federal employee on paper. You lock in your benefits and you lock in your pension to grow just like you’re a federal employee still on the rolls at your agency.

When Is It Right for You to Apply?

Caleb: Now let’s talk about when is it right for you to apply. We’ll talk about the timing here. We’ve discussed prior whether an active or modified duty station would count.

Like we already said, it is not considered to be a full accommodation if you’re working modified duty or with an injury or illness that is causing problems with your performance, attendance, or conduct.

We’ve also used the term “full and efficient service” when talking about this concept of active or modified duty. Even if you’re doing 99% of your job, if there is 1% of your job that you’re unable to medically perform, that would still qualify you. That means it is right for you to apply.

Now I’d like to transition and talk about when it’s right for you to apply—the timeline of this. Any number of situations and experiences might impact your decision on when it’s right to apply for Disability Retirement.

One of the common situations that I see whenever somebody’s considering Disability Retirement is whether or not they’re working still full-time, full duty, or whether they’re working on a modified or light duty station.

So if you’re working but it’s light duty, if you’re not performing—again, fully successful, full and efficient service—if you’re not performing 100% of your job, or if you’re missing time, if your attendance is not where it needs to be, if your conduct is not satisfactory, then that’s a signal right there. That signal should tell you that it’s time to consider at least whether or not you would qualify for Disability Retirement. If your health is starting to have a tangible impact on your ability to do your job, that experience alone should tell you that moving forward you have other options. You can medically retire.

Katelyn: That’s a great example, Caleb. And another one that we see pretty frequently are people that have burned through their leave. So if you’re using your leave, if you’re dependent on FMLA [Family and Medical Leave Act], leave without pay, you’re using your sick or annual leave and you have no expectation of being able to return to work soon, then Disability Retirement is something that you may need to consider.

The LWOP Situation

Katelyn: So a common scenario I see is someone that’s been on LWOP [Leave Without Pay] for a long time. They’re really worried about their financial status, even possibly their insurance. But the benefit of Disability Retirement is the nice annuity that you’re going to get every single month and also being able to keep your federal employee benefits. So LWOP is a very common reason that we see people apply for Disability Retirement.

And even if you aren’t in LWOP status yet, if you’re having to use leave often or your annual leave, it is possible for you to still apply for Disability Retirement. So you don’t have to think of it as “I have to use all my leave before I can do this.” Don’t think of it that way, but you need to anticipate what could happen if you were to use all your leave.

Caleb: That’s right. I speak with a lot of federal employees who are very worried because they feel like they’re stuck between not being able to return back to work and having to leave altogether, having to really consider a permanent leave of absence from their work. And that is a very difficult decision to make.

I reassure a lot of federal employees that if you do pursue this, you’re not saying goodbye to your benefits. You still get to retain—rather—your federal benefits and move forward. You don’t have to feel stuck like there’s nothing left for you to do. You have other options even if you’re out of work on an indefinite leave of absence.

Combining Disability Retirement with Other Benefits

Caleb: There’s also a lot of situations where federal employees are on other benefits, other disability benefits like OWCP [Office of Workers’ Compensation Programs], workers’ comp, wage loss. They’re also receiving Social Security Disability Insurance, and then a very, very high number of our clients are receiving some form of VA [Veterans Affairs] disability compensation.

So if you’re receiving other federal benefits like this and you’re unlikely to return to full duty status, then you can qualify for Disability Retirement. That might be another signal for you to know that it’s the right time for you to consider this.

Key Point: If you’re receiving VA disability or your workers’ comp or disability from Social Security, if you’ve been receiving those for quite some time now and there might not be an ability for you to return to full duty status with your position within your agency, then you can collect Disability Retirement and those other benefits at the same time.

What Your Doctor Is Telling You

Katelyn: And finally, another thing to consider is what your doctor has been saying to you. So if you’re regularly treating with a doctor and they’re encouraging you to find a different job, if they’re saying you need restrictions, you can’t do certain parts of your job, it’s not good for you, or it’s not compatible with your medical condition, then it would be very worth considering Disability Retirement in that case. Because OPM’s going to be looking for medical proof, and having treatment with an established medical professional is really going to support your claim.

Caleb: That’s right. That’s absolutely right, Katelyn.

Filing After Separation: The One-Year Deadline

Caleb: And I want to talk about what happens even after you’ve been separated, because a lot of federal employees are worried even after they’ve left their agency. If they’ve been separated or fired, you still do have the ability to submit your application, but there is a one-year deadline to file your application with OPM.

So be very mindful here. If you have your separation date, calculate one year from that date, and that is your deadline. So you can still file for Disability Retirement. It can still go directly to OPM if you’ve been separated for longer than one month. But once that deadline is passed, you cannot retroactively file and collect Disability Retirement after that deadline has been met.

Important Warning: Now, don’t confuse your employment status with your OWCP claim. I only mention this because we’ve seen this happen quite often. Just because you’re on workers’ comp, it doesn’t mean that you’re still employed. You might be on leave without pay, or you might be separated.

If you’re receiving pay stubs from your agency that says you’re still on record, you’re still receiving leave without pay, then you should still be considered a valid employee. But if you are not, then your agency may have proposed your removal. So keep that in mind and make sure that you know your employment status if you’ve been on workers’ comp, if you’ve been on OWCP.

Key Summary Points

Caleb: All right, so just to summarize the webinar here, just to highlight the key points. Now we’ve talked about all of these, but I encourage you—if you still have questions—ask our firm. We also have folks like myself and Katelyn who are here nine to five working on consultations, speaking with federal employees, having these discussions daily.

So if you have questions about what is Disability Retirement, what’s your monthly annuity, your health and life insurance benefits, how to know when or if you qualify, we’re here to help. This is what we want to do. We want to be able to serve our clients and potential clients and let them know what their options are. So those are the key points that we’ve discussed here.

How Harris Federal Can Help

Caleb: And the last bit is how we can help and what Harris Federal is here to accomplish for you as a federal employee. Do not risk your future with this. There’s a lot of money that you stand to gain, and having an experienced legal team on your side takes the burden off your shoulders. This is a way for us to be giving you support so that you can focus on your health, you can focus on your recovery. You do not need the added stress and worry of a legal battle hanging over your shoulders. This can be a way for you to hand the work off to a firm of confident professionals.

We are at a 99% success rate. We have served over 10,000 clients, and 10,000 federal employees. So if you have any concerns, if you’re looking to consider Disability Retirement, Harris Federal would be honored to walk you through that application process together so that way you can focus on what really is important, and then we can do the tough paperwork, the legal battle, whatever needs to be taken care of to get OPM to approve your claim.

The Application Process

Caleb: For anyone considering whether to apply for Disability Retirement, whenever you submit your application, this would be the very first time that you’ve submitted anything close to this to OPM, to the Office of Personnel Management. To submit your retirement is a huge decision to make, but it’s an even bigger process—of application, of red tape, of criteria that needs to be met.

And what our firm does is we’ve specialized in this exact process. So we know exactly what OPM is looking for, and we can tailor our application to any federal employee. We can make sure that the medical narrative and the agency, the reasonable accommodation process—that the whole thing will go smoothly from start to finish. We don’t want there to be any bumps in the road. We don’t want there to be any obstacles. We anticipate what’s around the corner so that you don’t have to.

We do all the heavy lifting. So, the application forms—they’re going to be perfect, they’re going to be worded properly to your situation. We’re going to take that burden off your shoulders so that you can relax; you can take care of what you need to do for your health and for your medical conditions. But what we want to provide is security and the solid professional assistance to make sure that OPM approves your application and that it is not a cause of stress or worry in your life.

Katelyn: And just to back up what Caleb said, we want to advocate for our clients. We know your rights as a federal employee. We’ll help you on your behalf to make sure that you’re being treated well by your agency and OPM. So, we’ll always be on your side. When you’re under a lot of stress or you’re just not feeling well, it’s hard to advocate for yourself, and that’s what we want to do for our clients.

Just know that if we don’t win your case after the appeals, we’re going to do right by you. We have a 100% money-back promise for a reason. We’re very confident in what we do, but we do act ethically with our clients.

If you’d like to learn more about your specific situation, set up a free no obligation call with us. We’ll help point you in the right direction.