Quick Takeaways

- Private sector earning potential is significant: You can earn up to 80% of your old position’s current salary while receiving Disability Retirement benefits, potentially reaching 140% of your original salary in year one.

- Survivor benefits are spouse-only: These annuity reductions only benefit your spouse and disappear if they pass first—you don’t get that money back.

- Health insurance reinstates retroactively: After approval, OPM will reinstate your health insurance back to the date you lost coverage, eliminating the gap.

- Your TSP stops growing from agency contributions: Once on Disability Retirement, you can no longer contribute to your Thrift Savings Plan, and the government won’t contribute either.

- Social Security timing requires strategic planning: When you start taking Social Security benefits significantly impacts your lifetime payout—waiting longer doesn’t always mean more money overall.

Common Questions

Q: How much will my interim payments be after approval?

A: Interim payments are typically around 80% of your final annuity amount and last approximately 4 months while OPM finalizes your benefits.

Q: Can I return to work for the federal government while on Disability Retirement?

A: You can, but your new federal paycheck will be offset by your Disability Retirement payment, making it financially disadvantageous compared to private sector work.

Q: What happens to my benefits when I turn 62?

A: Your Disability Retirement automatically converts to regular FERS retirement, and all credible service years earned while on disability are factored into your new retirement calculation, increasing your payment.

Q: How often does OPM review my disability status?

A: OPM conducts annual reviews every February, checking both your income level and medical status—but these reviews rarely result in benefit termination.

Q: What are my options for my Thrift Savings Plan after retiring on disability?

A: You have three options: leave it where it is, roll it over to a private sector financial vehicle, or withdraw it (though early withdrawal may incur penalties depending on your age).

Full Webinar Transcript

What to Expect After Approval

Bo Harris (President, Harris Federal Law Firm): What we’ll cover today in this webinar is we’re going to go over a lot of different stuff that a lot of our clients ask us all the time. We’re going to be going over back pay, private sector work, survivor benefits, health and life insurance options, financial planning, your TSP [Thrift Savings Plan], and what happens once you’re approved from OPM [Office of Personnel Management] in terms of a yearly review.

The first thing that we need to be talking about is understanding what the benefit looks like once you’re approved for Disability Retirement. Kimberly, can you share a little bit of information with us about what someone can expect once they have a Disability Retirement claim approved?

Understanding Interim Payments

Kimberly Bear (Director of Case Processing): Absolutely. One of the big questions we get a lot is about the payments. Those first payments that you are going to receive from OPM are going to be your interim pay. Those payments are going to be a little bit lower than your regular annuity payment, typically around 80% of what your finalized payments are going to be. That way it lowers the chances of OPM overpaying you. OPM will finalize those payments and pay them out once they do so.

Bo: So, once you’re approved, there’s a period that you’re not receiving your full Disability Retirement payments. About how long does that last, Kimberly?

Kimberly: This interim payment typically takes about four months. You’ll be receiving it for about four months while OPM finalizes those payments, and then that’s when your finalized annuity payments will start.

Health and Life Insurance Reinstatement

Bo: All right, perfect. What about post-approval in terms of insurance? What do we tell people in terms of how they can or can’t keep insurance?

Kimberly: The insurance is, of course, a big concern. If you’ve lost your insurance, once you’re approved and your benefit is finalized by OPM, they will reinstate your health insurance if you’re eligible, and your life insurance as well. In the meantime, you won’t have that coverage, but OPM does offer you the option to reinstate it retroactively, and that would be reinstated the date that you lost that coverage.

Bo: That’s good stuff. That’s really important because insurance is something that we all need, so it’s good to know that.

Working in the Private Sector While on Disability Retirement

Bo: Now let’s talk about private sector work and how that pertains to someone who is approved for Disability Retirement. Not all federal employees who get approved for Disability Retirement will be able to work in the private sector, but there are several that will. If you might be one of those people, you need to know what that looks like.

Key Point: The eligibility requirement for Disability Retirement is not proving that you’re totally disabled—you’re proving that you have an occupational disability and inability to fully perform your job, not any job out there, just your job. That leaves room for people to be able to do other kinds of jobs.

Bo: In fact, we have a lot of clients—and Kimberly, I’m sure you hear this every day—we have a lot of clients that move on and do pursue some other career.

Kimberly: Absolutely. Personally, a lot of my clients that can work in the private sector, they do. They move on, they start a new career while receiving that Disability Retirement, and it turns out really great for them.

The 80% Earning Cap Explained

Bo: We’ve had examples of people who have gone on to be teachers and realtors and all sorts of stuff, so that might be a possibility for you. What you need to be aware of is the 80% cap.

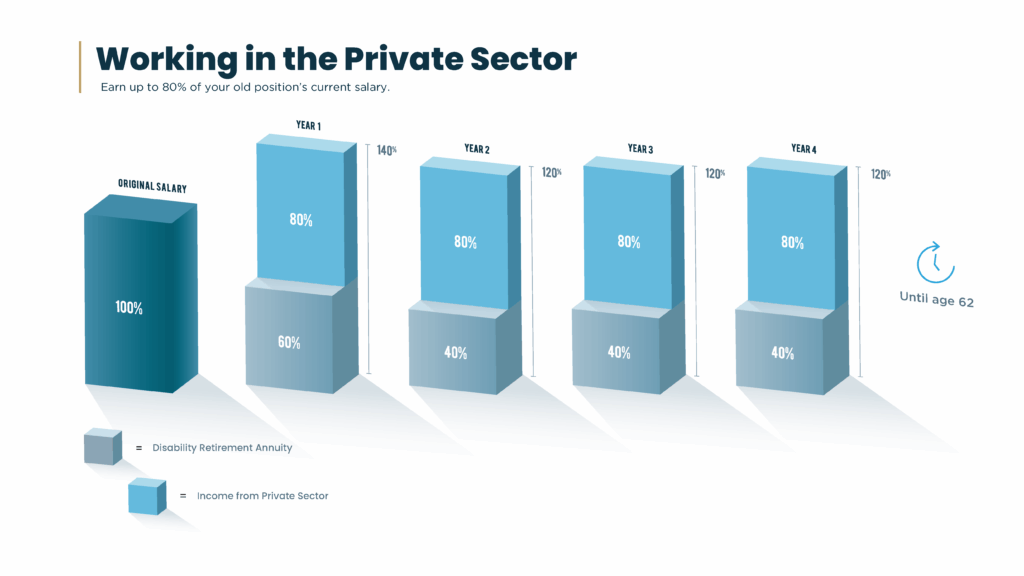

If you are one of the people who can work in the private sector, you’re going to be limited to only earn up to 80% of your old position’s current salary while you’re on Disability Retirement. This is a great chart here that represents not only what your Disability Retirement is but also what you can earn while working in the private sector.

The lower part here represents your Disability Retirement annuities—so it’s 60% for the first year and then 40% for every year after that. But then you can see on top of that, we’re stacking your earning potential in the private sector, which is significantly important to understand, especially if you’re one of those people who can go work.

Kimberly: That’s right, Bo. As you can see in this graph, if you are able to work in the private sector and earn that 80% in addition to the Disability Retirement, it’s going to be a huge benefit. The first year you can actually receive 140% of your original salary, and the second year and every year after, you can receive 120% of your original salary up until the age of 62, which is really, really wonderful.

Bo: And I think that’s something that people don’t think about. Another thing to mention too is that this is based upon your original—your old job’s current salary. So, in fact, it can actually increase over time.

Kimberly: You are correct. So, if your position got five raises you are eligible to make 80% of those five raises, it’s beneficial.

What Not to Do: Returning to Federal Employment

Bo: So, there are a few things that we want you to be aware of when we talk about returning back to work. Especially one thing that you shouldn’t do while you’re on Disability Retirement is go back to work for the federal government.

Kimberly: Exactly. If you return to work for the federal government, your new paycheck will be offset by your Disability Retirement payment, so that is not good.

Bo: That’s definitely not good. That’s not what we want for you. But also keep in mind too that if you do go work in the private sector, it’s a good idea to find a different type of job, so it’s not similar to what you were doing as a federal employee, and especially what you were doing when you got qualified for Disability Retirement.

Kimberly: Yes, we do want to stay within those medical restrictions in your new position.

Understanding Survivor Benefit Options

Bo: Now let’s move on and talk about a big subject that we hear about a lot here in our office. A lot of our clients ask us all the time about what survivor benefits are right for them. Kimberly has a ton of experience in talking to clients about these annuities and about these different options, and I’m going to let her walk us through what these options are and how they can work for you.

Kimberly: Yeah, absolutely, Bo. I discuss this with my clients on a daily basis.

That maximum survivor annuity means that your annuity payment is going to be reduced by 10%, and this will allow you to leave 50% of your unreduced annuity to your spouse in the event that you pass first. It also allows them to carry over health benefits if they carry it through you in this agency.

The second option is going to be that partial survivor annuity, and this option means that your annuity payments would be reduced by 5% each month. In the event that you passed before your spouse, they would then receive 25% of your unreduced annuity and again would still be eligible for that health coverage.

And then the very last option is the no survivor annuity. This option states that your annuity payments will not be reduced, but this in turn leaves no benefit for your spouse, and they would be unable to carry over that health coverage.

Who Qualifies as a Survivor?

Bo: Okay, so those are obviously great options and very well explained, thanks Kimberly. But let’s talk about who qualifies as a survivor. When people are choosing which option that they want, they need to know that actually their spouse is the only one that qualifies as a survivor.

Kimberly: That is right. Unfortunately, only their spouse can be left this annuity, and so that’s important to know because if your spouse were to pass first, the reduction that you essentially paid just disappears, and you do not receive that money back.

Bo: So that’s a great point, and people need to understand that it’s not like life insurance in that sense. You don’t have multiple beneficiaries that you can leave this annuity to, and that might be enough reason to not choose it for some people. But obviously some people might need it in the sense that, for example, your spouse may be uninsurable, so they might really benefit from the health insurance if that’s something that they need and they can’t get somewhere in the private sector.

Kimberly: That’s exactly right.

Terminating Events for Survivor Annuities

Bo: Okay, so there are other things that you need to take into consideration when making your choice of survivor annuity options, and one of those is understanding what are the terminating events around a survivor annuity. Kimberly, can you walk us through what the terminating events are?

Kimberly: Absolutely. So there are three terminating events that will end this annuity reduction. Like we just discussed, the death of a spouse is going to be one of the reasons that would end that annuity. Essentially you will not receive what you paid back, but you would no longer have to reduce that annuity that you’re receiving.

The next event would be a divorce. This would terminate your reduction in those payments. If you and your spouse were to get divorced, then you wouldn’t have to pay essentially for that benefit.

And the last event is going to be if your former spouse then gets remarried before age 55, then you do not have to have those payments reduced any longer.

Bo: And talk to us about the two-year time limit that you have to make these elections, these new elections.

Kimberly: You would have to be the one to file this with OPM, and you do have to do it within two years of whichever terminating event has happened.

Making Your Survivor Benefit Election

Bo: You can tell that survivor annuity options is a loaded topic. There’s a lot of information there that needs to be digested and understood for federal employees when they’re making their specific elections. One thing to note for Disability Retirement applicants: you’re going to have to make this election during the application process, right Kimberly?

Kimberly: That is correct. We will discuss these options with you so that you can determine which is going to be best for you, but we do have to make a decision before we send in your application. Now you can note that you can make that decision and change it within 30 days of being approved, but essentially this is a permanent option once you choose it.

Bo Harris: So, the important thing here is just really knowing why you’re choosing which option you’re choosing, and that’s one thing that we can help you out with.

Health Insurance During Retirement

Bo: Moving on, let’s talk about another pretty loaded topic as well—insurance within Federal Disability Retirement. We get a lot of people who are concerned and confused about what they can and can’t do with insurance as they go into Federal Disability Retirement.

One thing to note is that you can keep your health insurance, and that’s great. A lot of people are reassured and happy when they hear that when you go on Disability Retirement, you can keep your health insurance. You have to continue to pay for it obviously, but you can keep your health insurance, which is a big benefit to a lot of federal employees.

Kimberly: That’s right, Bo. And one more thing to kind of make note of is the survivor election. Options one and two do allow your spouse to carry over that health coverage if they carry it through you in the agency, so keep that in mind when making that decision as well.

FEGLI Life Insurance Options

Bo: And then also life insurance—we get a lot of people who are concerned about not only the cost of their life insurance but what options do they have to keep life insurance throughout Federal Disability Retirement. Another good note is that you can keep your FEGLI, your Federal Employee Group Life Insurance.

There are several parts to FEGLI. Here are your three different options in addition to your basic life insurance options. You’ve probably heard about these throughout your federal career. You probably have these in place in some form or fashion, but we’re just restating this so you know what options you have during retirement as it pertains to life insurance. Kimberly, can you walk us through what this is?

Kimberly: Yeah, Bo. Your first option is going to be Option A, which is your standard insurance, and that is just a flat $10,000.

Next, you’re going to have your Option B, which is your additional optional insurance. Now, Bo, this one can be up to five times your salary, depending on what you choose.

And then Option C is going to be your family insurance, where you could insure children or spouses up to five times those multiples as well.

Bo: That’s great. Now one thing to remember too is the premiums for these insurances continue to go up, right? So just keep in mind that it might be in your best benefit to consider some form of life insurance in the private sector and the private market that might be more beneficial to you, because these premiums get really expensive the older that you get. So just keep that in mind. Again, we’re not here to tell you which one to choose. We’re just trying to make you aware of what options that you have through retirement.

Kimberly: Exactly.

Financial Planning Considerations

Bo: Okay, so here are some things to consider when you’re talking about financial planning through Disability Retirement.

Kimberly: A couple of things to know are going to be your Thrift Savings Plan, the private sector financial products, and Social Security. We get a lot of questions on all three of these topics, and Bo is very experienced on the financial side. Bo, could you explain more about the TSP side of things?

Understanding Your Thrift Savings Plan

Bo: Absolutely, I’d be happy to. The first thing that we need to understand is what is a Thrift Savings Plan and how does it fit into my retirement package?

The Thrift Savings Plan is essentially the government’s version of a 401(k), and it’s available for all federal employees, whether you’re FERS or CSRS. It’s something that you’ve had access to. It’s a part of your retirement plan, and it’s intended to be there for your retirement.

The next thing is what you need to know about your Thrift Savings Plan once you’ve retired: you can no longer contribute to your TSP, and that’s a really important fact.

Kimberly: Bo, I get this question a lot from my clients, and they really need to know what options they have if they can no longer contribute to their TSP.

Bo: That’s probably the number one question that we get, right?

Kimberly: Yes. What can I do with my Thrift Savings Plan now that I’m on Disability Retirement?

Three Options for Your TSP

Bo: Absolutely. You have three options: you can leave it, you can roll it, and you can withdraw it.

Leaving it: You can just leave it where it’s at. You don’t have any requirement to take it anywhere, to do anything with it. You can still leave it in the Thrift Savings Plan, but remember you can’t contribute to it anymore, and the federal government certainly will not continue to contribute to it the way that they have in the past. So, you can leave it there, but that might not be the best option, especially if you’re trying to continue to accrue the value of that Thrift Savings Plan.

Rolling it over: A lot of people roll it over, and we see this a lot. A lot of people now that they’re in the private sector have a stronger desire to look in different markets for different products, different financial products—and we’re going to get into that here in a second—but you can roll it over to different financial vehicles versus just leaving it where it’s been.

Withdrawing it: Lastly, you can withdraw it. You may incur a penalty depending upon your age—it’s very likely—but you can withdraw the benefit as needed too.

Important Recommendation: With that being said, we strongly recommend that when making these decisions and considerations, you speak with a financial advisor, especially one that has experience in helping federal employees. If you’re looking for more information on that or if you need help finding a financial advisor that has experience with federal employees, talk to us. Our office would be happy to try to help point you in the right direction to make sure that you’re making good decisions there.

Kimberly: Absolutely, Bo. This is an extremely important decision on what to do with these benefits, so talk to your case manager. Give us a call. We can help you find somewhere or point you in the right direction.

Social Security Benefits Explained

Kimberly: All right. Now that we have a little bit more information on the TSP, another question that I get a lot is in regards to Social Security. Now, to be clear, this isn’t the Social Security Disability benefit, but the regular Social Security benefit that you get at retirement age. Bo, can you give us a little bit more information on that benefit?

Bo: Absolutely. So, the first thing that someone needs to know is what age they are going to be when they’re eligible to receive the full Social Security benefits.

So this is a really cool illustration here, and you can find what year you’re born to figure out the exact age that you will be when you’re eligible for the full Social Security benefit, which leads to this next graph, which will show you what percentage of the full benefit you can be eligible to receive based upon the year you start taking Social Security.

The Myth of “Waiting Longer Is Always Better”

Bo: It’s really interesting—the longer you wait, it looks like the more benefit that you get. And we see this a lot where people think, because it kind of makes sense, they think that the longer you wait, the better it is in terms of how much of the benefit you get. But there’s a whole lot of other factors that play into that equation.

In fact, we find a lot of times people that wait till the very end don’t get as much benefit as they could if they took the Social Security in full earlier. Now again, this is something that takes a lot of evaluation, and so we strongly recommend that you speak to an experienced financial advisor to show you exactly when the best time is for you to take that benefit.

Kimberly: That looks like a lot of good information, and I do feel like getting a financial advisor is going to be the best way to go.

Bo: And again, if you’re looking for somebody, we can help point you in the right direction. We know a lot of people out there who do this, and we can help you find a good fit for you.

What Happens at Age 62

Bo: Okay, moving on. Kimberly, let’s talk about what happens when you turn 62 years old. A lot of people say, “Well, you know, Disability Retirement lasts until I’m 62, so what happens at age 62?”

Kimberly: Absolutely. My clients ask me this a lot as well. At 62, what’s going to happen is your regular retirement is going to kick in. It’s going to be automatically converted by OPM, and then also around this time, you will be eligible to start drawing those Social Security benefits.

Bo: That’s exactly right, Kimberly. Great information. One thing to remember too is that at age 62, when your Disability Retirement converts to regular FERS retirement, at that point in time, all those additional years of credible service that you’ve earned while on Disability Retirement will also be factored into the calculation of your regular retirement, and they’re going to actually increase what that regular retirement payment looks like for you.

Health and Life Insurance at 62

Kimberly: That’s exactly right, Bo. And then the last thing that’s going to happen is in regards to your health and life. Now, these benefits—if you were eligible to carry them over with your Disability Retirement—they are going to remain the same. Keep in mind those life insurance premiums may rise. They typically are a lot higher at this age, but you are eligible to carry them over if you would like.

Bo: Also, while we’re talking about the life and health insurance real quick, Kimberly, can you tell us about the requirements to maintain health and life insurance through Disability Retirement in terms of how long you have to have it before you’re qualified?

Kimberly: Absolutely. When you’re applying for Disability Retirement, you have to have had the health and life insurance for at least five years, or as long as you were eligible if it was less than five years that you were employed. But typically, at least five years to be able to carry it over into Disability Retirement.

Annual OPM Reviews

Bo: Okay, so now we’re getting to the final part of our webinar, and we’re going to talk about the OPM reviews. This is something once you’re on Disability Retirement that you just need to be aware of. Every year, there’s going to be some reviews in regards to your benefits. Kimberly, can you walk us through this. You explain this to your clients every day, and we’d love to hear how this works.

Kimberly: Absolutely. So, the first thing that you have to be aware of is that income review. OPM will send out this survey every February, and this is just to request proof of your employment. They want to make sure that you’re below that 80% income cap, and then also just take note that it’s only your earned income that’s going to count towards that 80%.

Medical Documentation Reviews

Kimberly: And then the next thing that OPM does want to check for is that medical review. Also in February, OPM will request updated medical documentation, and this just shows that you do have the same disability that you were approved for and that you’re still treating. We do typically recommend that you still treat with your doctor at least about every six months after you’ve been approved for this benefit.

Bo: That’s right, Kimberly. And one other thing I want to say is that this medical review that they do every year—it’s not intended to be something that they do to kick you off of your benefit. It’s just OPM’s way to keep up with the status of your disability. So, we don’t see people losing their benefits very often.

Kimberly: That is exactly right. And so, this medical review is very normal. You don’t have to be too panicked or too worried if you get this from OPM.

Final Thoughts

Bo: Okay, so that brings us to the key point. We’ve talked a lot today, Kimberly, about a lot of important things for federal employees to consider whenever they’re going through Disability Retirement. If you’re somebody who’s likely to be approved for Disability Retirement, this is intended to be for you so you can really help navigate what your future financially looks like in Disability Retirement.

Kimberly: Yes, that’s absolutely right. This is all some really great information. I know it’s a lot, but it is all very important when planning your financial future.

Bo: And one thing—just remember that we’re here. We’re here for you. If you have more questions about what we talked about here today in this webinar, please get in touch with our office. You can contact us anytime. We’d be happy to talk with you about your specific situation and hopefully help you or at least point you in the right direction.

If you’d like to learn more about what your life could look like on Disability Retirement, book a free consultation today.