Quick Takeaways

- VA disability never reduces other benefits: Read more about VA Disability and how it might interact with Disability Retirement.

- Workers’ compensation and Social Security Disability have a combined 80% earning cap: Combined payments cannot exceed 80% of pre-disability salary. Learn more about Workers’ compensation and Social Security Disability.

- Federal Disability Retirement allows private sector work: You can work elsewhere while receiving FDR benefits until age 62 if you remain in the 80% earning cap. Read more about working after Disability Retirement.

- Social Security Disability reduces Federal Disability Retirement significantly: FDR reduced by 100% first year, then 60% until age 62.

- You can receive multiple disability benefits simultaneously: Learn how to maximize your income through strategic combinations.

Common Questions

Q: Can I receive workers’ compensation and Social Security Disability at the same time?

A: Yes, but combined benefits cannot exceed 80% of your pre-disability salary.

Q: Does VA disability reduce my other benefits?

A: No. VA disability is calculated independently and has no negative impact on other benefits.

Q: Can I work while receiving Federal Disability Retirement?

A: Yes, you can work in the private sector while receiving FDR benefits.

Q: What happens to my federal benefits if I get Disability Retirement?

A: You keep your federal health insurance and life insurance as if you’re still employed.

Q: How does Social Security Disability affect Federal Disability Retirement?

A: FDR is reduced by 100% of SSDI in the first year, then 60% thereafter until age 62.

Full Webinar Transcript

Understanding Your Disability Benefit Options

Hannah: Today we’re going to be talking about how your disability benefits will interact. It’s crucial for you to understand how these benefits interact because we want you to be able to maximize your benefits and your finances. Some disability benefits work with one another and some work against one another, so it’s important to know what is available to you and what your best options are.

Caleb (Senior Disability Consultant): The goal for today’s session is to kind of go through disability benefits for federal employees and how they all interact. We’re going to start by going through a very high-level kind of general explanation of disability benefits and then towards the second half of the webinar we’re going to be talking about how these benefits interact because there is a lot of – VA veterans disability, Disability Retirement, social security – there’s a lot of different types of disabilities so we want to make sure that everybody understands how all these benefits will interact.

Michelle (Case Manager Supervisor): I am super happy to be here with you today Caleb to talk about all of these different possibilities for disability for someone who might need them.

Overview of Today’s Topics

Caleb: To summarize the discussion topics we’ll be talking about today – number one: what disability benefits are there. If you’re suffering from a disease, injury, disability – mental, physical – there’s a lot of different disabilities that qualify somebody for benefit. Number two: what is an offset – what does it look like when you receive two different kinds or multiple different kinds of disability benefits. The third would be the interactions between each benefit and the fourth would be how to maximize your benefits.

Some benefits will offer to pay financial either monthly payments, annuities, some will cover health insurance costs or for family members. There’s a lot of different benefits that one would qualify for for themselves and for others.

Michelle: There are four main disability benefits we’ll discuss: OWCP (workers’ compensation), SSDI (Social Security Disability Insurance), VA disability, and FDR (Federal Disability Retirement).

Workers’ Compensation Benefits (OWCP)

Caleb: When a federal employee is injured while performing job duties at work or develops an occupational illness or disease, they have the right to file a federal workers’ compensation claim. We often talk about folks who are traumatically injured – they’re either suffering from broken arm, leg, back, knee, shoulder, etc. – really any kind of on-the-job injury that was traumatic. But then you also have a second type which would be an occupational illness or disease which is more of a slow, more of a wear and tear ongoing type of medical condition.

Workers’ compensation offers three main benefits to those who are injured on the job and each one has different qualification requirements.

Wage Loss Payments

Michelle: The first benefit that OWCP offers is wage loss payments. This is going to be a percentage of your salary while you miss work and you’re out for one of those injuries or illnesses. OWCP will pay you a percentage of your salary and that amount depends on whether or not you have dependents. If you do not have dependents, it will be 66% of your salary. If you do have dependents, those wage loss payments are 75% of your salary.

Medical Coverage

Caleb: Alongside those wage loss payments, OWCP is also going to cover any medical treatment. The OWCP will cover your medical expenses pertaining to your approved claim if you qualify for medical coverage. It’s important to note here that not all doctors are familiar with OWCP procedures and some of them will not accept OWCP patients at all, so it’s important to ask your doctor if they’re familiar with or if they accept OWCP medical coverage.

Key Point: Medical coverage is for the lifetime of the medical condition. If this requires multiple months or years of treatment, then OWCP is liable to cover those expenses.

Schedule Awards

Michelle: A third benefit offered by OWCP is the schedule award. A schedule award is a lump-sum payment for a permanent impairment to any particular body part. The OWCP created a schedule of body parts that instructs federal workers on what qualifies for a schedule award. Essentially each body part is awarded a certain amount that it is worth and that depends on the percentage of disability established for that body part.

The head and back, though they are major body parts, they are the two major body parts that are not included in this schedule. However, if the head or back are causing impairments to other extremities you could still qualify for a schedule award on those extremities or impacted body parts.

You can’t receive your schedule award and wage loss payments at the same time. The schedule award typically comes after the wage loss payments have concluded.

Social Security Disability Insurance (SSDI)

Caleb: SSDI is kind of by a simple definition total and permanent disability. Social Security Disability Insurance provides monthly payments and health coverage for totally disabled federal and non-federal employees. This is a benefit that even if you were not a federal employee, you’d still qualify for if you’re unable to work entirely. This is a total and permanent disability benefit.

However, you must have worked long enough and recently enough to qualify for SSDI. This does not necessarily have to be an on-the-job injury or disability – this could be any kind of medical condition or impairment that prevents you from performing substantial gainful activity.

Understanding Substantial Gainful Activity

Michelle: If you are able to continue working in some capacity while you are on the SSDI benefit, there are limits to how much you can earn. You must remain within the substantial gainful activity limit, and this number changes every year. It is based on inflation. In 2024 that amount was $1,550 per month or if you are blind, that number is $2,590 per month.

VA Disability Benefits

Caleb: VA disability is for a service-connected disability. This is stemming from military service. VA disability is a monthly benefit available to former military service members who have a disability or injury due to their service. With this, you can receive healthcare coverage and monthly disability payments based on your military pay and this income is completely non-taxable.

As I’m sure a lot of you guys are familiar with, this is a percentage scale or a rating scale that the VA determines and that determines the monthly annuity or monthly disability payments that you would receive. Of course, the VA does provide healthcare to veterans.

Federal Disability Retirement (FDR)

Michelle: This is the primary benefit that we assist with as a law firm, and it is an early retirement option. It’s an early retirement option specifically for federal employees who are struggling in their job due to a medical condition. This benefit is administered by the Office of Personnel Management [OPM] and it serves as a bridge and lasts until you are age 62 when you are eligible for your regular federal retirement.

Caleb: Calling it a bridge is a great way to explain what this benefit does because it continues to pay if you’re a federal employee who’s unable to continue working. It’ll pay you a monthly annuity payment – you’ll receive a portion of your high three average salary with creditable years of service. This will continue to pay you until you turn 62 years old but it’s also going to continue to count service credit towards your full federal pension whenever you turn 62.

This is certainly a long-term benefit that’s very stable and it’ll also allow you to work in the private sector if you’re able to do so. This is different from Social Security or SSDI – this is not total and permanent, this is more of an occupational type of disability.

You’ll also receive your health and life insurance – your Federal Employee Health Benefit, your group life insurance plan. Those benefits are going to remain static. You’ll be able to retain those benefits as if you’re still employed with no change to yourself or to your family members who might be covered – your spouse, your children, those dependents would still be included in your life insurance and health insurance plan.

How Benefits Interact With Each Other

Michelle: Now that we’ve talked about all these different benefits, let’s spend a moment talking about how they interact and how they might impact one another. Receiving multiple benefits at any one time may mean that they could interact negatively. Not all interactions are negative – they might simply exist together – but there are things called offsets meaning that one benefit may counteract another benefit and this varies depending on the benefits in question.

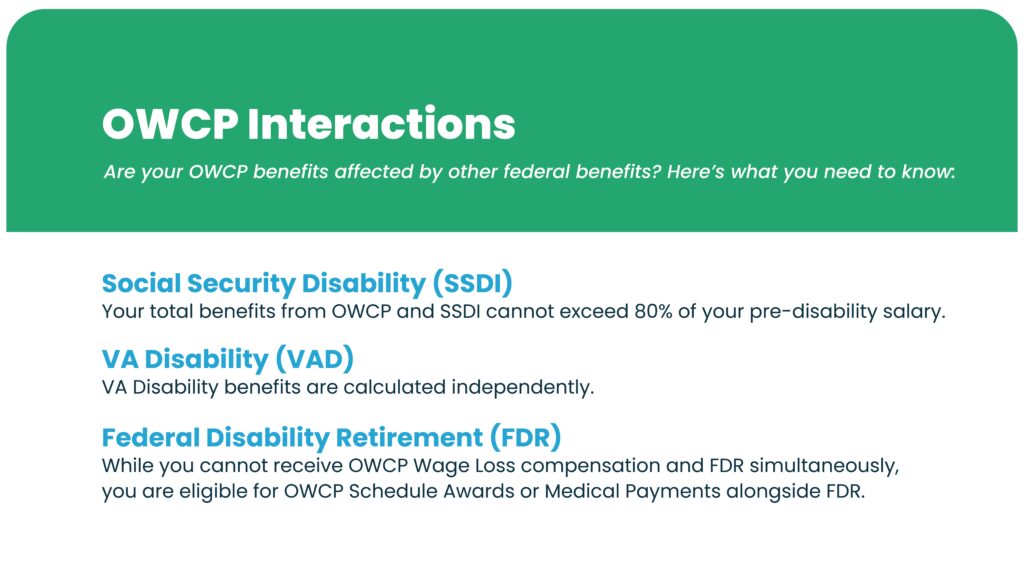

Workers’ Compensation (OWCP) Interactions

Caleb: Are your OWCP benefits affected by other federal benefits? This answer is going to vary person to person and situation to situation.

OWCP + Social Security Disability

Your total benefits from OWCP and SSDI cannot exceed 80% of your pre-disability salary. There’s a hard cap with both benefits combined that cannot exceed 80% of what your salary would have been prior to your disability.

OWCP + VA Disability

VA disability benefits are calculated independently, so there is no interaction or negative offset between OWCP and VA disability.

OWCP + Federal Disability Retirement

While you cannot receive wage loss compensation and FDR simultaneously, you are eligible for schedule awards or medical payments alongside FDR. What this means is essentially your monthly income may come from Disability Retirement or OWCP whichever one is greater, and then the medical treatment and the schedule awards from workers comp you could receive those alongside the Disability Retirement benefits.

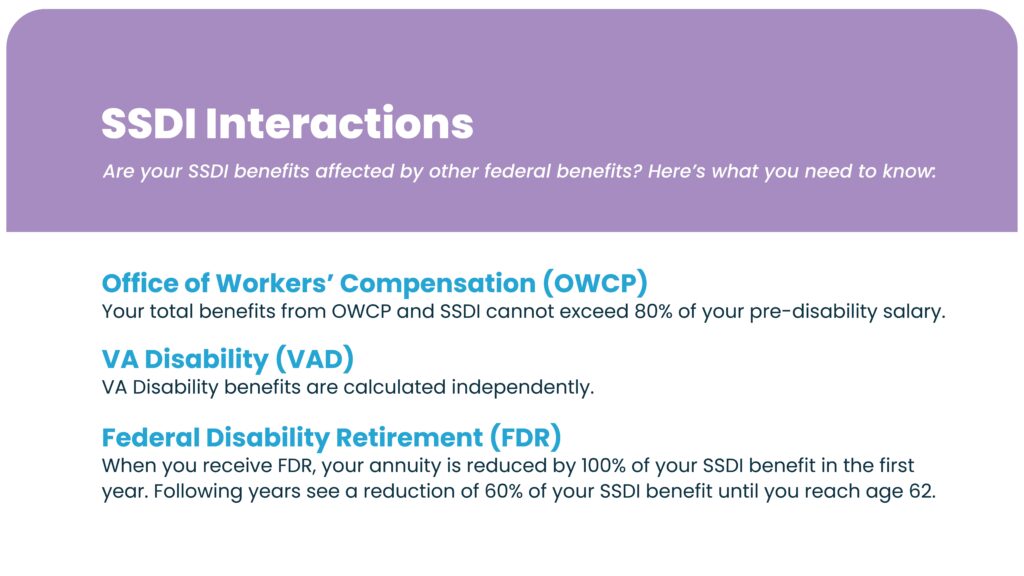

Social Security Disability (SSDI) Interactions

Michelle: Your total benefits from workers comp and Social Security Disability cannot exceed 80% of your pre-disability salary. If you do have OWCP and Social Security Disability, that 80% becomes your cap.

VA disability is calculated independently and does not have an interaction with Social Security Disability.

For Federal Disability Retirement, there is an interaction between Federal Disability Retirement and your Social Security Disability. In this case your FDR annuity is reduced by 100% of your SSDI benefit in the first year. Following that, the reduction drops to only 60% of your SSDI benefit until you reach age 62. After that first year you do get more money for having both benefits.

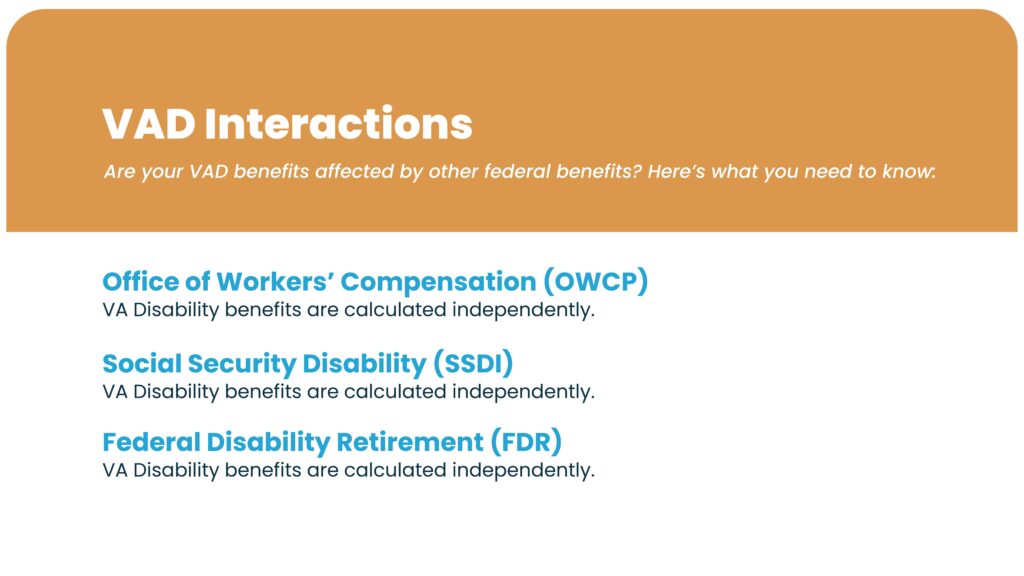

VA Disability Interactions

Caleb: This one across the board is the same answer. For OWCP, for SSDI, and for Federal Disability Retirement there is no offset reduction and VA disability benefits are calculated independently. If you’re interested in receiving any other type of disability besides VA disability, keep in mind that there is no reduction, penalty, or offset. You can receive both benefits – really you can receive them in full and the VA disability will not change.

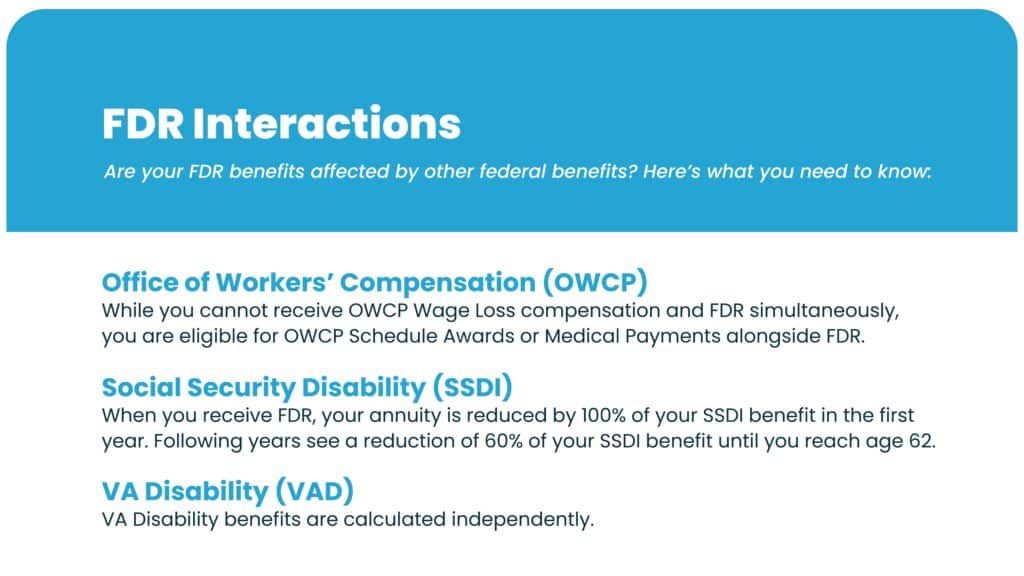

Federal Disability Retirement Interactions

Michelle: We did already address how these interact with the other benefits in the previous slides but we do want to reiterate because this is the benefit that we focus the most on here at Harris and we can help the most with.

It’s important to reiterate that there is an offset with workers compensation benefits and that is that you cannot receive the wage loss payments at the same time as you receive your Disability Retirement payments but you are eligible for schedule awards or medical payments while you have your FDR benefits.

On Social Security Disability, your annuity is offset by 100% of your Social Security Disability in the first year but after that, that offset drops to 60% until you reach age 62.

As I mentioned, VA disability is calculated independently and has absolutely no impact on this benefit.

Maximizing Your Benefits

Caleb: I hope this helped y’all to understand how to maximize your benefits and how all these interact and offset with one another. You can receive multiple of these disability benefits at once consecutively to provide you with the most financial benefit. Everyone’s going to have unique questions, every situation is going to be different.

Caleb: Take advantage of your disability benefits – I think that is the bottom line here. There are a lot of different types of disability – really four main disability benefits that we covered today for federal employees specifically which is OWCP workers compensation, Social Security Disability Insurance, VA disability, and federal disability retirement. You may be able to receive multiple benefits at once in order to benefit the most financially and be able to maximize your income and your medical care which is very important.

When you’re making all these important decisions and looking through your options, don’t risk your future, don’t risk going about these situations with any unanswered questions or any kind of unknown. We’re here to help, we’re here to answer those questions, give you full clarity and confidence when you’re navigating this because it can be very difficult and very stressful to navigate all of this alone.

Harris Federal’s experienced legal team has done over 10,000 Federal Disability Retirement cases with about 99.9% overall success rating for approval and over 1,500 five-star reviews on Google.

If you’ve got questions, call for a free consultation and we’ll help you determine the best path forward.